Are you curious about the maximum number of bitcoins that can ever be mined? Understanding this limit is crucial for anyone interested in investing or trading cryptocurrencies. To help you solve this topic, here are two informative articles that delve into the concept of the max number of bitcoin:

Unveiling the Mystery: The Ultimate Limit of Bitcoins

"Unveiling the Mystery: The Ultimate Limit of Bitcoins" provides a comprehensive and insightful exploration into the inner workings of the popular cryptocurrency, Bitcoin. The article delves into the concept of Bitcoin mining, discussing the finite supply of 21 million Bitcoins and the potential implications this may have on its value in the future. The author skillfully breaks down complex technical concepts into easily understandable terms, making it accessible to readers of all levels of expertise in the field.

One practical use case for Bitcoin highlighted in the article is its role as a hedge against inflation. With traditional fiat currencies being subject to inflationary pressures, Bitcoin's fixed supply offers investors a store of value that is immune to such fluctuations. This has led to many individuals and institutions turning to Bitcoin as a safe haven asset in times of economic uncertainty, resulting in positive outcomes such as increased wealth preservation and portfolio diversification.

Overall, "Unveiling the Mystery: The Ultimate Limit of Bitcoins" is a must-read for anyone looking to gain a deeper understanding of Bitcoin and its potential impact on the future of finance. The article is expertly written, informative, and engaging, making it a valuable resource for both novice and experienced cryptocurrency enthusiasts around the world.

Breaking Down the Math: How the Max Number of Bitcoins is Determined

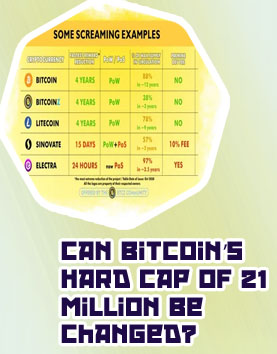

Bitcoin, the world's first decentralized digital currency, has a maximum supply cap of 21 million coins. But have you ever wondered how this limit was determined? The answer lies in the intricate mathematical algorithm that governs the creation of new Bitcoins.

The process of generating new Bitcoins is known as mining, where miners use powerful computers to solve complex mathematical equations. As more miners join the network, the difficulty of these equations increases, leading to a decrease in the rate at which new Bitcoins are created. This mechanism, known as the "halving" process, occurs approximately every four years and is designed to mimic the scarcity of a finite resource like gold.

The total supply of 21 million Bitcoins is based on the principle of diminishing returns. As more coins are mined, the reward for miners decreases, making it progressively harder to generate new Bitcoins. This ensures that the supply of Bitcoins will eventually reach its limit, creating scarcity and driving up the value of the currency.

Understanding the mathematical underpinnings of Bitcoin's supply cap is crucial for investors and enthusiasts alike. It highlights the deflationary nature of Bitcoin, making it an attractive store of value in an inflationary world. By grasping the intricacies of how the max number of Bitcoins is determined, individuals can make informed decisions