Understanding the circulating supply of Bitcoin is crucial for investors and enthusiasts alike. By knowing how many coins are currently in circulation, one can better assess the market dynamics and potential future price movements. The following three articles provide valuable insights into the topic of Bitcoin circulating supply, shedding light on its implications and significance in the world of cryptocurrency.

Demystifying Bitcoin's Circulating Supply: What You Need to Know

Bitcoin's circulating supply is a crucial concept to understand for anyone looking to delve into the world of cryptocurrencies. The circulating supply refers to the total number of bitcoins that are currently available to be bought, sold, or traded on the market. It plays a significant role in determining the value and price of Bitcoin, as well as influencing investor sentiment and market trends.

One key aspect to consider when discussing Bitcoin's circulating supply is the concept of scarcity. Unlike traditional currencies that can be printed endlessly by central banks, Bitcoin has a fixed supply cap of 21 million coins. This limited supply is what gives Bitcoin its value and makes it a sought-after asset by investors looking for a hedge against inflation and economic uncertainty.

It is important to note that not all 21 million bitcoins are currently in circulation. A significant portion of bitcoins are held in long-term storage or lost due to forgotten passwords or hardware failures. This means that the actual circulating supply of Bitcoin is lower than the total supply cap of 21 million coins.

Understanding Bitcoin's circulating supply is essential for investors, traders, and anyone interested in the cryptocurrency market. By grasping this concept, individuals can make more informed decisions when buying or selling Bitcoin, as well as better comprehend the factors influencing its price movements.

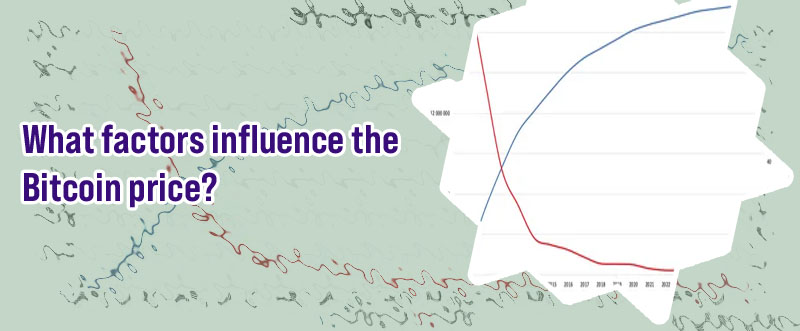

The Impact of Bitcoin's Circulating Supply on Price Volatility

Bitcoin's circulating supply plays a crucial role in determining its price volatility. The total number of bitcoins that are in circulation can have a significant impact on the market dynamics, as it directly affects the supply and demand balance. When there is a high circulating supply of bitcoins, it can lead to increased price volatility, as there are more coins available for trading. On the other hand, a lower circulating supply can result in more stable prices, as there are fewer coins available for purchase.

One practical use case that demonstrates the impact of Bitcoin's circulating supply on price volatility is the recent halving event. Bitcoin's circulating supply is programmed to decrease every four years through a process known as halving. This event reduces the number of new bitcoins being mined, leading to a decrease in the overall supply. As a result, the scarcity of bitcoins increases, which can potentially drive up the price due to increased demand.

During the most recent halving event in May 2020, Bitcoin's price experienced a positive trend, reaching new highs in the following months. This demonstrates how changes in the circulating supply of Bitcoin can directly influence its price volatility and create opportunities for investors to profit from the market dynamics. By understanding the relationship between circulating supply and price volatility, traders and investors can make informed decisions to navigate

Analyzing Bitcoin's Circulating Supply Trends: A Deep Dive into Market Dynamics

This in-depth analysis delves into the market dynamics that influence the supply and demand of the world's most popular <a href"/">Bitcoin news digital currency.