If you are looking to profit from shorting Bitcoin (BTC), it is important to have a solid understanding of the market and the strategies involved. These four articles will provide you with valuable insights and tips on how to successfully navigate the world of BTC shorting.

The Ultimate Guide to Shorting Bitcoin: Strategies and Risks

Investing in Bitcoin can be a lucrative endeavor, but for those looking to capitalize on its potential downfall, shorting Bitcoin may be the way to go. In the volatile world of cryptocurrency, having a solid understanding of shorting strategies and risks is essential.

One comprehensive resource that delves into this topic is an insightful guide that covers everything from the basics of shorting to advanced strategies for maximizing profits and minimizing losses. The guide provides a detailed overview of how shorting works, the various methods available for shorting Bitcoin, and the potential risks involved.

Here are 3 key takeaways from the guide:

- Shorting Bitcoin involves borrowing Bitcoin from a broker and selling it at the current market price with the goal of buying it back at a lower price in the future.

- Shorting strategies such as margin trading, futures contracts, and options can be utilized to profit from a decline in Bitcoin's price.

- Risks associated with shorting Bitcoin include the potential for unlimited losses, margin calls, and market volatility.

Overall, this guide is a valuable resource for anyone looking to navigate the complex world of shorting Bitcoin. By arming yourself with knowledge and understanding the risks involved, you can make informed decisions and potentially profit from Bitcoin's price movements.

Tips for Timing Your Bitcoin Short Positions

When it comes to trading cryptocurrencies like Bitcoin, timing is everything. Knowing when to enter and exit a short position can make all the difference in maximizing profits or minimizing losses. Here are some expert tips to help you time your Bitcoin short positions effectively.

One important factor to consider is market sentiment. Pay attention to news events, social media trends, and market analysis to gauge the overall sentiment towards Bitcoin. If there is a lot of fear and uncertainty in the market, it may be a good time to enter a short position.

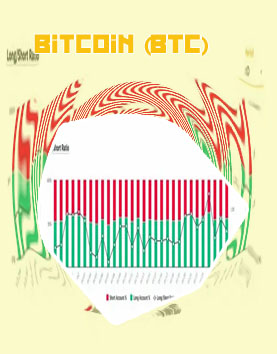

Technical analysis is another key tool for timing your Bitcoin short positions. Look for patterns and indicators on price charts that signal a potential downturn in the market. Popular indicators like moving averages, RSI, and MACD can help you identify entry and exit points for your short trades.

It's also important to consider the overall trend of the market. If Bitcoin is in a strong downtrend, it may be wise to wait for a pullback before entering a short position. Conversely, if Bitcoin is in an uptrend, you may want to be more cautious about shorting the market.

Lastly, always use stop-loss orders to protect your capital. Set a stop-loss at a level where you are comfortable taking a loss, and stick to your trading plan. By following

Understanding Margin Trading and Leverage in Bitcoin Shorts

By using borrowed funds, traders can amplify their potential profits, but they also increase their <a href"/">Bitcoin news risk of significant losses.

Top Mistakes to Avoid When Shorting Bitcoin

Shorting Bitcoin can be a lucrative strategy for investors looking to profit from the cryptocurrency's price declines. However, there are several common mistakes that traders often make when shorting Bitcoin that can lead to significant losses.

One of the most common mistakes to avoid when shorting Bitcoin is failing to set a stop-loss order. A stop-loss order is a predetermined price at which a trader will exit their position to limit their losses. Without a stop-loss order in place, traders risk losing more money than they can afford if the price of Bitcoin suddenly spikes.

Another mistake to avoid when shorting Bitcoin is failing to do proper research. It's important to stay informed about market trends, news events, and technical analysis when shorting Bitcoin. Failing to do so can result in making uninformed decisions that lead to losses.

Additionally, overleveraging is a common mistake that traders make when shorting Bitcoin. Using too much leverage can amplify losses and wipe out a trader's account quickly. It's important to use leverage carefully and only trade with money that you can afford to lose.

In conclusion, avoiding these common mistakes when shorting Bitcoin can help traders minimize their losses and increase their chances of success. By setting stop-loss orders, doing thorough research, and avoiding overleveraging, traders