Understanding the factors that influence the price of Litecoin can be crucial for investors and traders looking to capitalize on its volatility. In order to make informed decisions, it is important to stay up to date on the latest news and analysis related to Litecoin's price movements. Below are three articles that delve into different aspects of Litecoin's price dynamics, offering insights and perspectives that can help you navigate the cryptocurrency market more effectively.

The Impact of Market Sentiment on Litecoin Price Fluctuations

The price of Litecoin, like many other cryptocurrencies, is heavily influenced by market sentiment. Market sentiment refers to the overall attitude or feeling of investors towards a particular asset, in this case, Litecoin. Positive market sentiment can lead to an increase in demand for Litecoin, driving up its price, while negative market sentiment can result in a decrease in demand and a drop in price.

There are several key factors that contribute to market sentiment and, in turn, impact the price fluctuations of Litecoin:

-

News and Events: News about Litecoin, such as partnerships, developments, or regulatory changes, can greatly influence market sentiment. Positive news tends to attract investors and drive up the price, while negative news can have the opposite effect.

-

Social Media and Forums: Social media platforms and online forums play a significant role in shaping market sentiment. Discussions, opinions, and rumors shared on these platforms can create FOMO (fear of missing out) or FUD (fear, uncertainty, doubt) among investors, impacting Litecoin's price.

-

Market Psychology: Investor psychology, including emotions like greed and fear, can also impact market sentiment. When investors are optimistic about the future of Litecoin, they are more likely to buy, driving up the price. Conversely, when investors are fearful,

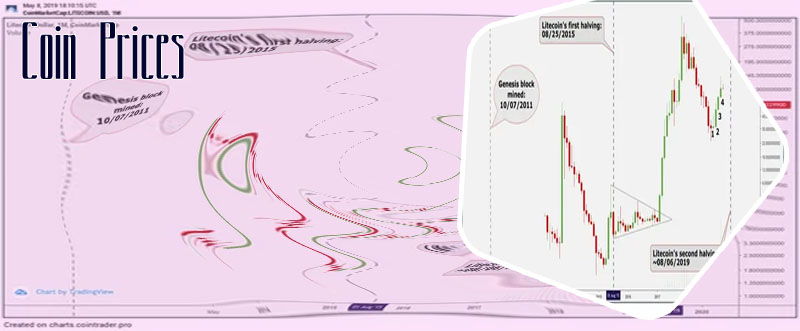

Analyzing Historical Trends to Predict Future Price Movements of Litecoin

Litecoin has been one of the most popular cryptocurrencies in the market, with a strong following and a history of price fluctuations. Traders and investors are always looking for ways to predict future price movements, and one method that has gained traction is analyzing historical trends. By examining past price data, patterns, and market behavior, analysts can attempt to forecast where the price of Litecoin may be headed next.

One key aspect of analyzing historical trends is looking at key support and resistance levels. These levels can give insight into where buyers and sellers are likely to enter the market, leading to potential price reversals or continuations. Additionally, analyzing volume trends can provide clues as to whether a price movement is sustainable or if it lacks conviction.

Another important factor to consider is market sentiment. By gauging how traders and investors feel about Litecoin, analysts can determine whether the market is optimistic or pessimistic, which can impact price movements. News events, market developments, and regulatory changes can all influence sentiment and ultimately affect the price of Litecoin.

In conclusion, analyzing historical trends to predict future price movements of Litecoin can be a valuable tool for traders and investors. By paying attention to key support and resistance levels, volume trends, and market sentiment, individuals can make more informed decisions when trading Litecoin. It is

The Role of Institutional Investors in Shaping Litecoin's Price Trajectory

These large <a href"/">Bitcoin news financial entities, such as investment banks, hedge funds, and pension funds, have the resources and influence to significantly impact the movements of Litecoin's value in the market.