Bitcoin's meteoric rise in value has left many wondering why this digital currency is worth so much. To shed light on this fascinating topic, here are four articles that delve into the reasons behind Bitcoin's high valuation. From its decentralized nature to its limited supply, these articles explore the various factors contributing to the value of Bitcoin.

The Decentralized Appeal of Bitcoin: Why it Matters

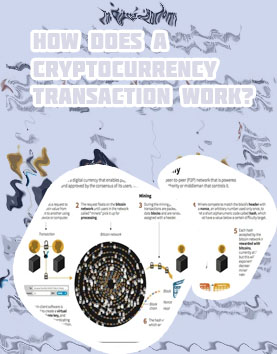

Bitcoin, the world's first decentralized digital currency, has revolutionized the way we think about money and finance. Created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto, Bitcoin operates without the need for a central authority or government. This decentralization is one of the key reasons why Bitcoin has gained so much popularity and why it matters in today's world.

One of the main appeals of Bitcoin is its ability to provide financial freedom to individuals around the world. With traditional financial systems, people are often subject to high fees, long processing times, and strict regulations. Bitcoin allows users to send and receive money quickly and securely, without the need for intermediaries. This has made it particularly appealing to those in countries with unstable financial systems or high levels of inflation.

Bitcoin has also attracted the attention of famous investors, such as Elon Musk and Paul Tudor Jones, who see it as a hedge against inflation and a store of value. In recent years, major companies like Tesla and PayPal have started accepting Bitcoin as a form of payment, further legitimizing its use as a currency.

Overall, the decentralized nature of Bitcoin provides a level of autonomy and control over one's finances that is unmatched by traditional financial systems. As the world becomes increasingly interconnected,

Understanding the Scarcity Factor: Why Bitcoin's Limited Supply Drives Value

In the world of cryptocurrency, the concept of scarcity plays a crucial role in determining the value of a digital asset. Bitcoin, the most well-known and widely used cryptocurrency, is known for its limited supply of 21 million coins. This scarcity factor is one of the key reasons why Bitcoin has garnered so much attention and value in the financial markets.

The limited supply of Bitcoin creates a sense of exclusivity and rarity, much like precious metals such as gold. As more people become interested in investing in Bitcoin, the demand for this digital asset increases, driving up its value. This scarcity factor also helps to protect Bitcoin from inflation, as the supply is capped and cannot be manipulated by central authorities.

One resident of Tokyo, Japan, Hiroki Tanaka, a financial analyst, shared his thoughts on the scarcity factor of Bitcoin. He mentioned that the finite supply of Bitcoin was one of the main reasons why he decided to invest in this digital currency. Tanaka believes that as more people realize the importance of scarcity in the world of finance, the value of Bitcoin will continue to rise.

Overall, understanding the scarcity factor of Bitcoin is essential for anyone looking to invest in this digital asset. The limited supply of Bitcoin not only drives up its value but also sets it apart from traditional fiat currencies.

The Role of Institutional Adoption in Bitcoin's Value Surge

Institutional investors, such as hedge <a href"/">Bitcoin news funds, family offices, and corporations, have started to view Bitcoin as a legitimate asset class, leading to increased demand and price appreciation.

Exploring the Role of Market Demand in Determining Bitcoin's Worth

Bitcoin's value has been a topic of much debate and speculation in recent years, with many experts attributing its worth to market demand. Market demand refers to the desire for a particular product or asset and the willingness to pay a certain price for it. In the case of Bitcoin, market demand plays a crucial role in determining its value.

Here are some key factors that influence market demand for Bitcoin:

-

Perceived value: Market demand for Bitcoin is often driven by its perceived value as a digital currency and investment asset. As more people view Bitcoin as a legitimate form of currency or as an alternative investment, the demand for it tends to increase.

-

Market trends: Market demand for Bitcoin can also be influenced by market trends, such as the rise or fall of other cryptocurrencies, changes in regulatory policies, or global economic events. These factors can impact investor sentiment and drive demand for Bitcoin.

-

Supply and scarcity: The limited supply of Bitcoin – with only 21 million coins ever to be mined – contributes to its scarcity and can drive up market demand. As the supply of Bitcoin dwindles, its value may increase as demand outstrips supply.

-

Media coverage and public perception: Media coverage and public perception can also impact market demand for Bitcoin.